Growing Global Population

The continuous increase in the global population is exerting pressure on food production systems, thereby influencing the oilseeds market. As the population is projected to reach nearly 9.7 billion by 2050, the demand for edible oils and protein sources derived from oilseeds is expected to surge. This demographic shift necessitates an expansion in oilseed cultivation to ensure food security. In 2025, the oilseeds market is likely to experience heightened demand, particularly in developing regions where population growth is most pronounced. This scenario presents both challenges and opportunities for producers, as they must adapt to meet the needs of a growing population.

Expanding Biofuel Production

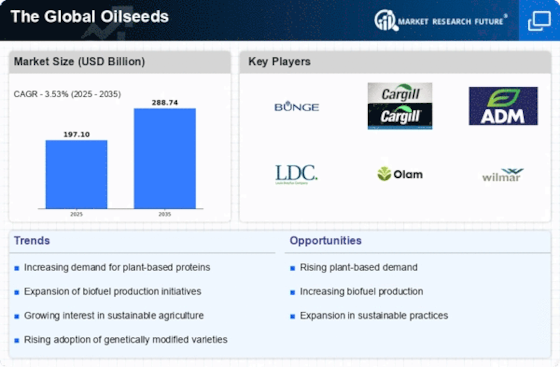

The Global Oilseeds industry, particularly in the production of biofuels. Oilseeds Market such as canola and soybean are increasingly utilized for biodiesel production, driven by government policies promoting sustainable energy. In 2025, biofuels are expected to account for a substantial share of the oilseeds market, with projections indicating a growth in biodiesel production capacity. This trend not only supports energy diversification but also enhances the economic viability of oilseed crops. As countries strive to reduce carbon emissions, the oilseeds market is likely to benefit from increased investments in biofuel technologies and infrastructure.

Rising Demand for Plant-Based Proteins

The increasing consumer preference for plant-based diets is driving the demand for oilseeds, particularly soybeans and peas. This trend is evident as more individuals seek alternatives to animal proteins, which has led to a notable rise in the production of plant-based protein products. In 2025, the oilseeds market is projected to witness a growth rate of approximately 5.5%, largely attributed to this shift in dietary habits. The growing awareness of health benefits associated with plant-based diets further fuels this demand, as consumers become more health-conscious. Consequently, the oilseeds market is adapting to meet this evolving consumer preference, potentially leading to innovations in product offerings and processing techniques.

Technological Innovations in Agriculture

Advancements in agricultural technology are transforming the oilseeds market, enhancing productivity and efficiency. Innovations such as precision farming, genetically modified organisms (GMOs), and advanced pest management techniques are enabling farmers to optimize yields and reduce costs. In recent years, the adoption of these technologies has led to a significant increase in oilseed production, with yields rising by approximately 10% in some regions. This trend is expected to continue, as farmers increasingly rely on data-driven approaches to improve crop management. Consequently, the oilseeds market is poised for growth, as enhanced productivity meets the rising global demand for oilseeds.

Increasing Use of Oilseeds in Animal Feed

The rising demand for livestock products is significantly impacting the oilseeds market, particularly in the context of animal feed. Oilseed meals, such as soybean meal, are essential components of animal feed, providing high protein content for livestock. As meat consumption continues to rise globally, the demand for oilseed meals is expected to increase correspondingly. In 2025, the oilseeds market is projected to see a substantial uptick in the use of oilseeds for animal feed, driven by the livestock sector's growth. This trend underscores the interconnectedness of food production systems and highlights the critical role of oilseeds in supporting the global food supply chain.